$5.5 Trillion AI Infrastructure Opportunity. Private Credit Preferred Funding Vehicle

Private Credit Markets Mobilize $1.8 Trillion for AI Infrastructure by 2030. Private Markets Outpace Traditional Financing in Race to Build AI Infrastructure

May 5, 2025 View Online | Sign Up | Open Roles

Thanks for reading! Please ask your friends and colleagues to sign up

Take Action Now

Leverage Prospect Rock Partners’ institutional expertise and market intelligence to optimize your positioning in this dynamic market.

· Learn more about Prospect Rock Partners’: Schedule a free 15-Minute Call

· Build a Strategic Financial Plan: Schedule a 1-hour Review

· Follow Prospect Rock Partners: Prospect Rock Partners on LinkedIn

· Buy Prospect Rock Partners’ 2024 IB Compensation Report: Buy the Report

· Submit your Resume for Career Opportunities: Submit your Resume

Energy Sector Market Intelligence

70% - San Francisco commercial real estate vacancy tops 35% in 1Q24. Buildings are renting up to 70% off 2020 prices.

267% - There are 5 solar cell producers in the US. Over 100 solar and storage manufacturing facilities have been announced since 2022. US solar cell production is expected to increase 267% by 2027.

10% - 3.5 gigatons of emissions from data centers will be added to the atmosphere by 2035. This is equivalent of 10% of total global emissions today.

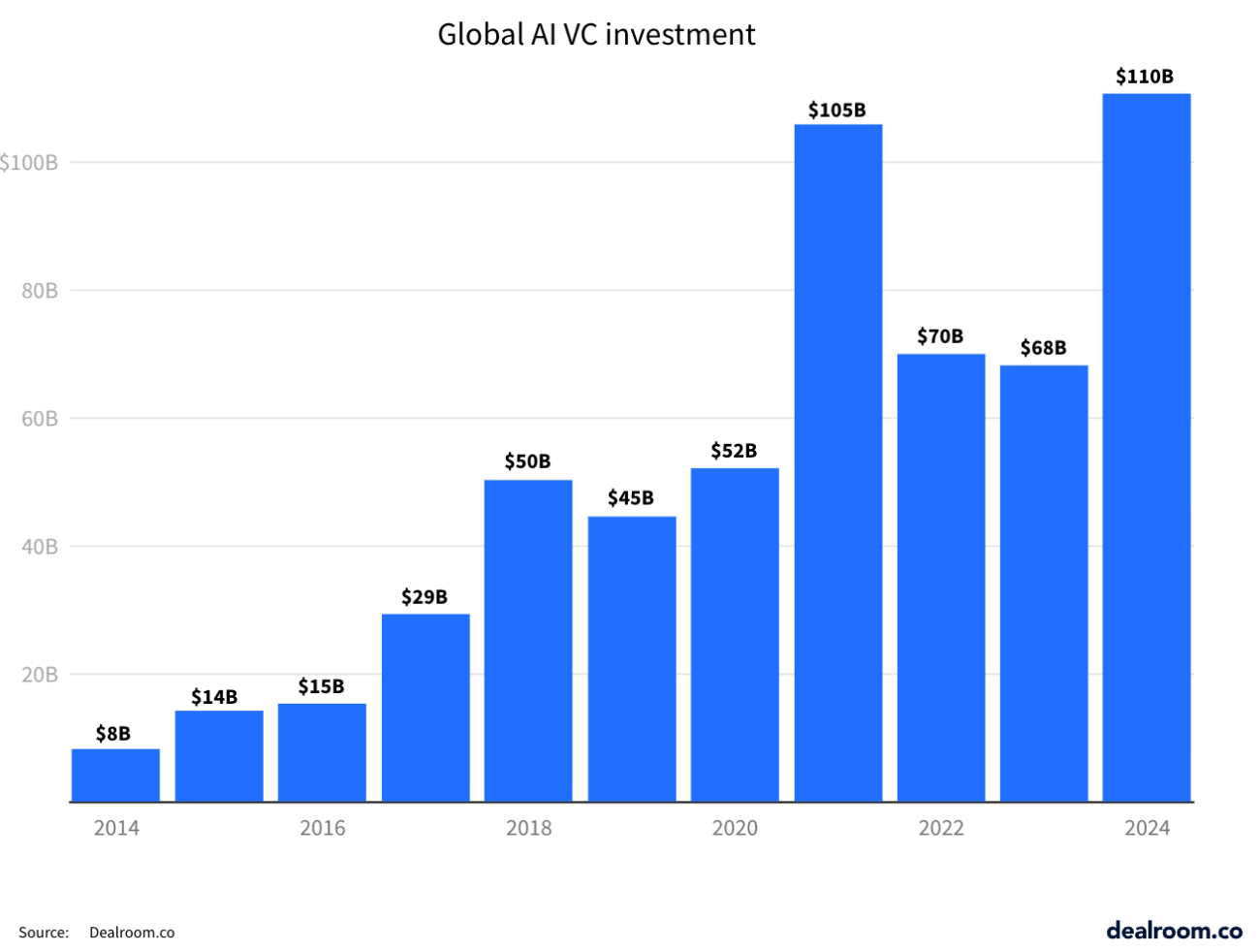

62% - Private investors could fund about $5.5 TN of capital across debt and equity in global infrastructure through 2035. Global VC funding was $26 BN in Jan-25, $5.7 BN (22%) for AI-related startups. $110 BN was invested in AI in 2024 - up 62% YoY.

30% - Residential solar power prices have fallen to $2.50/W, the lowest in 10 years. Solar panel prices dropped 30% year-over-year in 2024

25x - 100% of U.S. energy storage projects will have U.S.-made batteries by 2030. Energy storage deployment has grown 25x since 2018.

156 GW - Data centers will require $6.7 TN by 2030. Demand from AI alone is $5.2 TN. 156 GW of AI-related data center capacity demand by 2030. $1.8 TN of capital will be deployed by 2030 to meet demand, mostly frrom private markets

Data Center Investment

Massive capital investments needed for data centers to support AI and traditional computing by 2030. An unprecedented capital expenditure requirement of $6.7 trillion for global data centers by 2030, with $5.2 trillion allocated specifically for AI processing infrastructure and $1.5 trillion for traditional IT applications.

156 gigawatts of AI-related data center capacity demand is expected by 2030, including 125 incremental gigawatts between 2025 and 2030.. About 15 percent ($0.8 trillion) will flow to builders for physical infrastructure development, 25 percent ($1.3 trillion) to energizers for power generation and cooling systems, and the majority—60 percent ($3.1 trillion)—to technology developers and designers producing computing hardware and chips.

Projections indicate that over $1.8 trillion of capital will be deployed by 2030 to satisfy this escalating demand, with a considerable portion expected to be fulfilled through private market financing channels. While traditional funding mechanisms such as asset-backed securities and conventional real estate debt instruments have historically supported data center projects, the current landscape is witnessing unprecedented private financing activity.

The scale of this trend is substantiated by broader projections indicating that private investors could potentially contribute approximately $5.5 trillion in combined debt and equity financing toward global infrastructure development through 2035. This significant capital allocation underscores the pivotal role of private credit markets in facilitating the physical infrastructure underpinning the artificial intelligence transformation.

Career Opportunities in Investment Banking and Private Equity

Actively placing candidates across all levels in investment banking and private equity. For career opportunities, please submit your resume

· Investment Banking Analyst 2/3 Consumer M&A, New York, NY

· Investment Banking Analyst 2/3 M&A (Boutique), Nashville, TN

· Investment Banking Associate 1/2 Restructuring (Elite Boutique), New York, NY

· Investment Banking Associate 2 Consumer M&A, New York, NY

· Investment Banking Associate 2 Consumer M&A, New York, NY

· Investment Banking Associate 2 Software M&A, San Francisco, CA

· Investment Banking Associate 2 Tech M&A, Charlotte, NC

· Investment Banking Associate 2 Tech M&A (Elite Boutique), Boston, MA

· Investment Banking Associate 2 Tech M&A (Top 10 US Bank), San Francisco, CA

· Investment Banking Associate 2/3 FIG M&A, New York, NY

· Investment Banking Associate 2/3 Software M&A, Boston, MA

· Investment Banking Associate Tech Coverage (Top 10 US Bank), San Francisco, CA

· Commercial Banking VP/SVP Portfolio Management, Chicago, Il

Strategic Advisory Services in Energy, Infrastructure & Real Estate Finance

Prospect Rock Partners brings unparalleled expertise in complex capital deployment across the energy, infrastructure and real estate sectors. With over 25 years at the forefront of institutional finance and investment, Prospect Rock Partners’ proven track record encompasses:

· $31.1 BN in total investments, including $30 BN in debt financing, $1 BN in private equity, and $100 MM in tax equity investments.

· Funding strategies across the complete spectrum of renewable energy (wind, solar, bioenergy, hydro, geothermal), cutting-edge energy transition technologies (energy storage, EV charging, hydrogen, carbon capture), infrastructure (bridges, roads, hospitals, airports, universities) and real estate (residential, commercial, industrial).

· Executive leadership experience at top-tier investment banks and private equity firms, offering unique insights into institutional investment decision-making.

Exclusive Advisory Services - Now Available

Prospect Rock Partners provides targeted, high-impact advisory services to help secure institutional funding. Comprehensive service offerings include:

· Strategic Investment Development: Transform your funding materials into institutional-grade presentations that resonate with investors.

· Precision Investor Targeting: Leverage our extensive network and market intelligence to identify and connect with the right funding partners.

· Due Diligence Preparation: Ensure you're fully prepared for investor scrutiny and critical funding discussions.

· Custom Funding Roadmap: Develop a clear, actionable strategy to achieve your specific financing objectives.

Written by Mark Dennes

Was this email forwarded to you? Sign up here.

Interested in podcasts?

· Check out ours here