AI is Taking Off. Private Lending has Exploded!

Strategic Advisory Services in Renewable Energy & Energy Transition Finance

Prospect Rock Partners brings unparalleled expertise in complex capital deployment across the renewable energy and energy transition sectors. With over 25 years at the forefront of institutional finance, Prospect Rock Partners’ proven track record encompasses:

· Orchestrating $31.1 billion in total investments, including $30 billion in debt financing, $1 billion in private equity, and $100 million in tax equity investments

· Pioneering funding strategies across the complete spectrum of renewable energy (wind, solar, bioenergy, hydro, geothermal) and cutting-edge energy transition technologies (energy storage, EV charging, hydrogen, carbon capture)

· Executive leadership experience at top-tier investment banks and private equity firms, offering unique insights into institutional investment decision-making

Exclusive Advisory Services - Now Available

Prospect Rock Partners provides targeted, high-impact advisory sessions to help organizations secure institutional funding. Comprehensive service offerings include:

· Strategic Investment Package Development: Transform your funding materials into institutional-grade presentations that resonate with investors

· Precision Investor Targeting: Leverage my extensive network and market intelligence to identify and connect with the right funding partners

· Due Diligence Preparation: Ensure you're fully prepared for investor scrutiny and critical funding discussions

· Custom Funding Roadmap Creation: Develop a clear, actionable strategy to achieve your specific financing objectives

Take Action Now

· Learn more about our strategic advisory services: Schedule a free 15-Minute Call

· Book a 1-hour Strategic Financial Review: Schedule a 1-hour Review

· Build a Simple 3-Step Process to Getting a Letter of Interest: Schedule a 1-1 Meeting

· Build a Custom Strategic Finance Plan: Let's Work Together

· For career opportunities: Submit your resume

· Please follow Prospect Rock Partners on LinkedIn: Prospect Rock Partners

Leverage Prospect Rock Partners’ institutional expertise and market intelligence to optimize your positioning in this dynamic market. Let's discuss how Prospect Rock Partners can advance your financing objectives.

Energy Sector Market Intelligence

75% -AI is really taking off - companies poured over $20 billion into AI just in the last quarter of 2024. But here's the interesting part: all these AI systems need a ton of power.

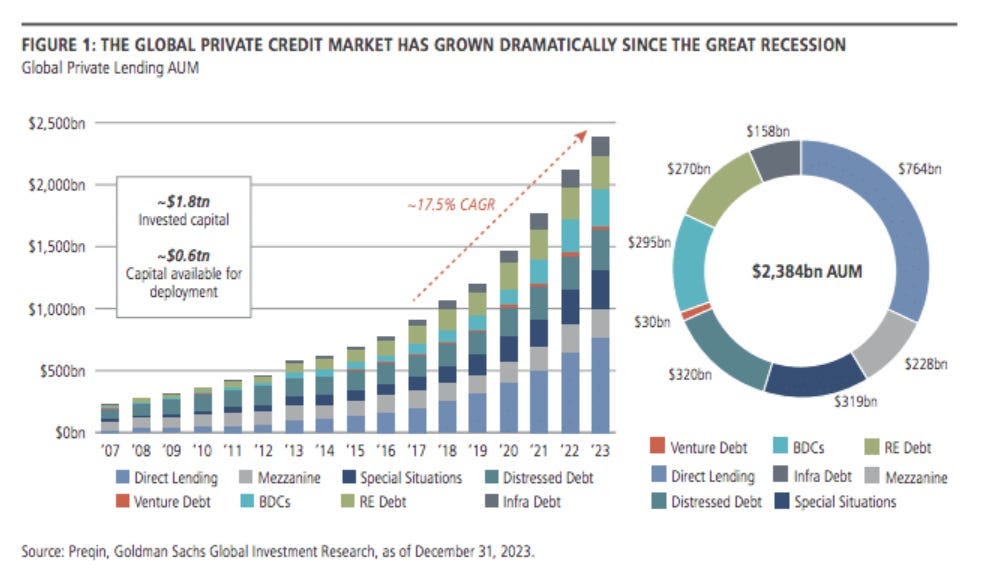

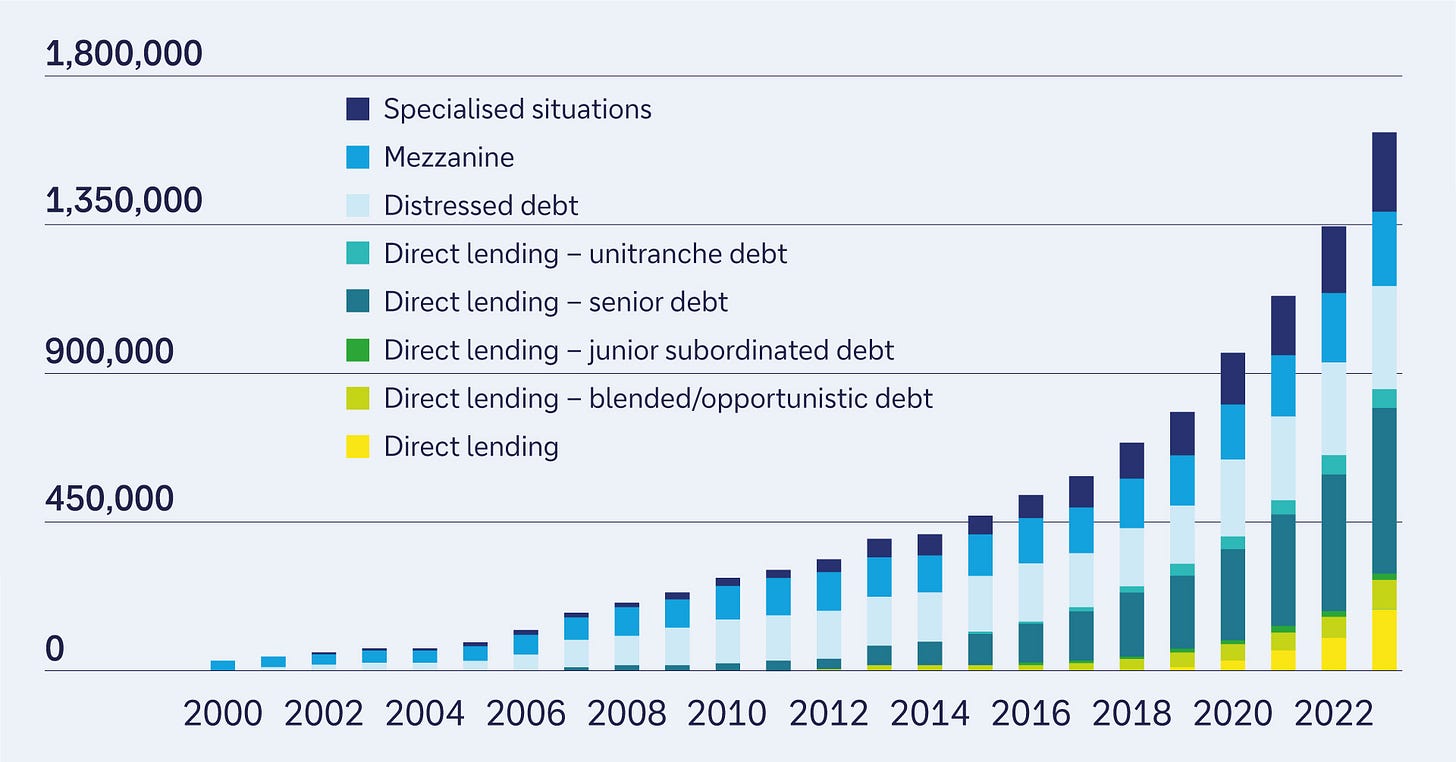

10x - Private lending has exploded - growing from $200 billion in 2009 to a whopping $2 trillion by the end of 2023.

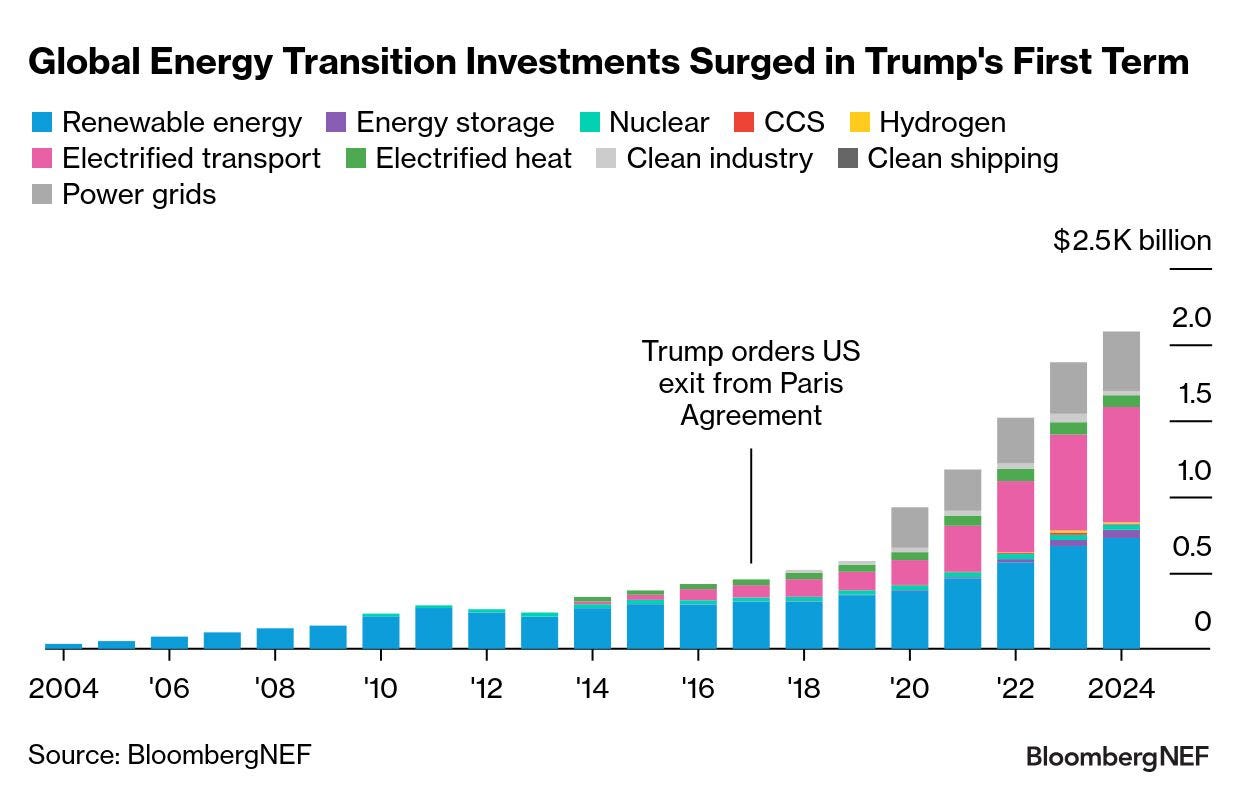

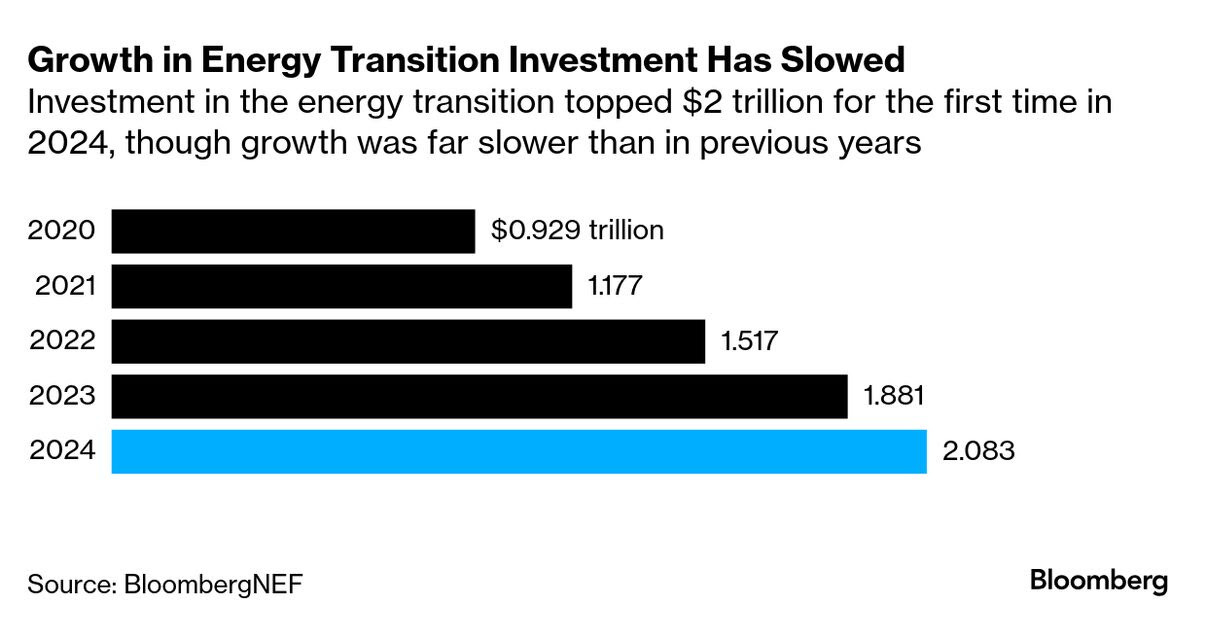

500% – Remember when renewable energy investment was around $426 billion back in 2016? Well, it's now hit $2.1 trillion in 2024 - that's a 500% jump!

700 GWh – The U.S. currently has 83 GWh of energy storage (including half a million small installations), but we're aiming for 700 GWh by 2030 with 10 million systems..

$55 BN – It's pretty clear where things are headed - AI is driving huge power demands, while clean energy and storage are scaling up fast to meet this need.

Strategic Analysis: Technology, Infrastructure & Capital Markets

Artificial Intelligence & Power Infrastructure:

The artificial intelligence sector continues to demonstrate exceptional growth dynamics, with capital formation reaching $20 billion in the third quarter of 2024 alone. This surge in AI development is creating significant implications for power infrastructure, with AI applications projected to account for approximately 75% of total U.S. power demand through 2035. The United Kingdom presents an even more dramatic trajectory, with AI-driven power demand expected to increase by 400% by 2030. Notably, technological innovations in infrastructure design are emerging as critical efficiency drivers, with deep water siting of data centers achieving up to 40% reduction in cooling costs through machine learning optimization.

Private Credit Market Evolution:

The private credit market has undergone a transformative expansion over the past fifteen years, growing tenfold from $200 billion in 2009 to exceed $2 trillion by the end of 2023. This market typically operates within well-defined parameters, with typical transaction sizes ranging from $10 million to $250 million and loan tenors spanning three to seven years. Pricing structures in this sector commonly feature a 400 basis point premium over the reference rate for publicly funded transactions, reflecting the risk-return profile of these investments.

Energy Transition Investment Landscape:

Investment in renewable energy and associated technologies has demonstrated remarkable growth, expanding fivefold from $426 billion in 2016 to $2.1 trillion in 2024. This surge reflects a diversification beyond traditional solar and wind investments to encompass electric vehicles, clean industry initiatives, and broader renewable energy applications. The debt capital markets have maintained steady momentum in this sector, with energy transition-related debt issuances growing 5% to reach $206 billion, indicating sustained institutional appetite for energy transition investments.

Critical Infrastructure Development:

The United States' energy storage infrastructure is undergoing significant expansion, with current capacity of 83 gigawatt-hours (GWh) including 500,000 distributed storage installations. National strategic objectives call for an ambitious scaling to 700 GWh of storage capacity by 2030, accompanied by a target of 10 million storage systems. Parallel infrastructure development in the electric vehicle sector reveals similar ambition, with plans to expand from the current base of approximately 190,000 charging stations to 1.2 million stations by 2030. This expansion carries significant capital requirements, with investment needs estimated at $55 billion to achieve full deployment.

Strategic Implications:

These intersecting trends highlight the scale of capital formation and infrastructure development required to support the ongoing energy transition and technological advancement. The convergence of AI-driven power demand, expanding private credit markets, and ambitious infrastructure targets suggests a complex but robust opportunity set for institutional investors and strategic capital deployment. The magnitude of required investment across these sectors indicates sustained momentum in market growth and technological innovation through the medium term.

Career Opportunities: Investment and Commercial Banking

Actively placing candidates across all levels in renewable energy finance:

· Investment Banking Analyst and Associate M&A roles in Biopharma, Consumer, FIG, Digital Entertainment, Life Sciences, Software and Technology.

· Investment Banking Associate roles in Restructuring Advisory

· Commercial Banking Vice President and Senior Vice President roles in Portfolio Management

· Financial Advisor Analyst and Associate roles in Energy Transition and Tax Equity.