American Battery Boom. Hydrogen Hopes Explode!

Strategic Advisory Services in Renewable Energy & Energy Transition Finance

Strategic Advisory Services in Renewable Energy & Energy Transition Finance

Prospect Rock Partners brings unparalleled expertise in complex capital deployment across the renewable energy and energy transition sectors. With over 25 years at the forefront of institutional finance, Prospect Rock Partners’ proven track record encompasses:

· Orchestrating $31.1 billion in total investments, including $30 billion in debt financing, $1 billion in private equity, and $100 million in tax equity investments

· Pioneering funding strategies across the complete spectrum of renewable energy (wind, solar, bioenergy, hydro, geothermal) and cutting-edge energy transition technologies (energy storage, EV charging, hydrogen, carbon capture)

· Executive leadership experience at top-tier investment banks and private equity firms, offering unique insights into institutional investment decision-making

Exclusive Advisory Services - Now Available

Prospect Rock Partners provides targeted, high-impact advisory sessions to help organizations secure institutional funding. Comprehensive service offerings include:

· Strategic Investment Package Development: Transform your funding materials into institutional-grade presentations that resonate with investors

· Precision Investor Targeting: Leverage my extensive network and market intelligence to identify and connect with the right funding partners

· Due Diligence Preparation: Ensure you're fully prepared for investor scrutiny and critical funding discussions

· Custom Funding Roadmap Creation: Develop a clear, actionable strategy to achieve your specific financing objectives

Take Action Now

· Learn more about our strategic advisory services: Schedule a free 15-Minute Call

· Book a 1-hour Strategic Financial Review: Schedule a 1-hour Review

· Build a Simple 3-Step Process to Getting a Letter of Interest: Schedule a 1-1 Meeting

· Build a Custom Strategic Finance Plan: Let's Work Together

· For career opportunities: Submit your resume

· Follow Prospect Rock Partners on LinkedIn: Prospect Rock Partners

Leverage Prospect Rock Partners’ institutional expertise and market intelligence to optimize your positioning in this dynamic market. Let's discuss how Prospect Rock Partners can advance your financing objectives.

Energy Sector Market Intelligence

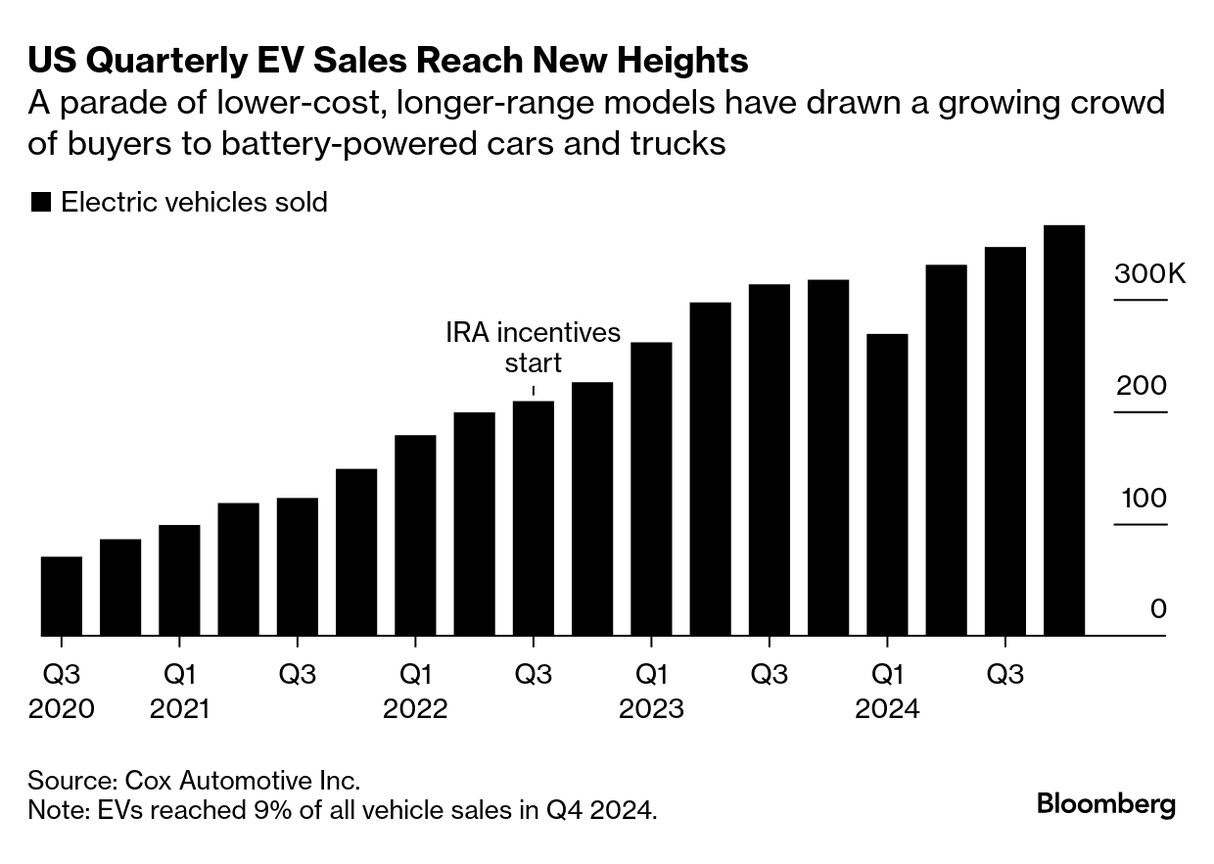

10% - Global energy transition investment was $2.1 TN in 2024, more than double since 2020. EVs were 10% of all vehicles sold in 4Q24, below the roughly 25% of people needed to take a stand before large-scale social change occurs.

400% - US battery manufacturing has increased over 400% since 2022 from 7 GW to nearly 40 GW. China makes 80% of the components needed to make solar panels. Imported solar energy resources, including solar polysilicon, wafers, and cells from China are now subject to 60% tariffs under Section 301.

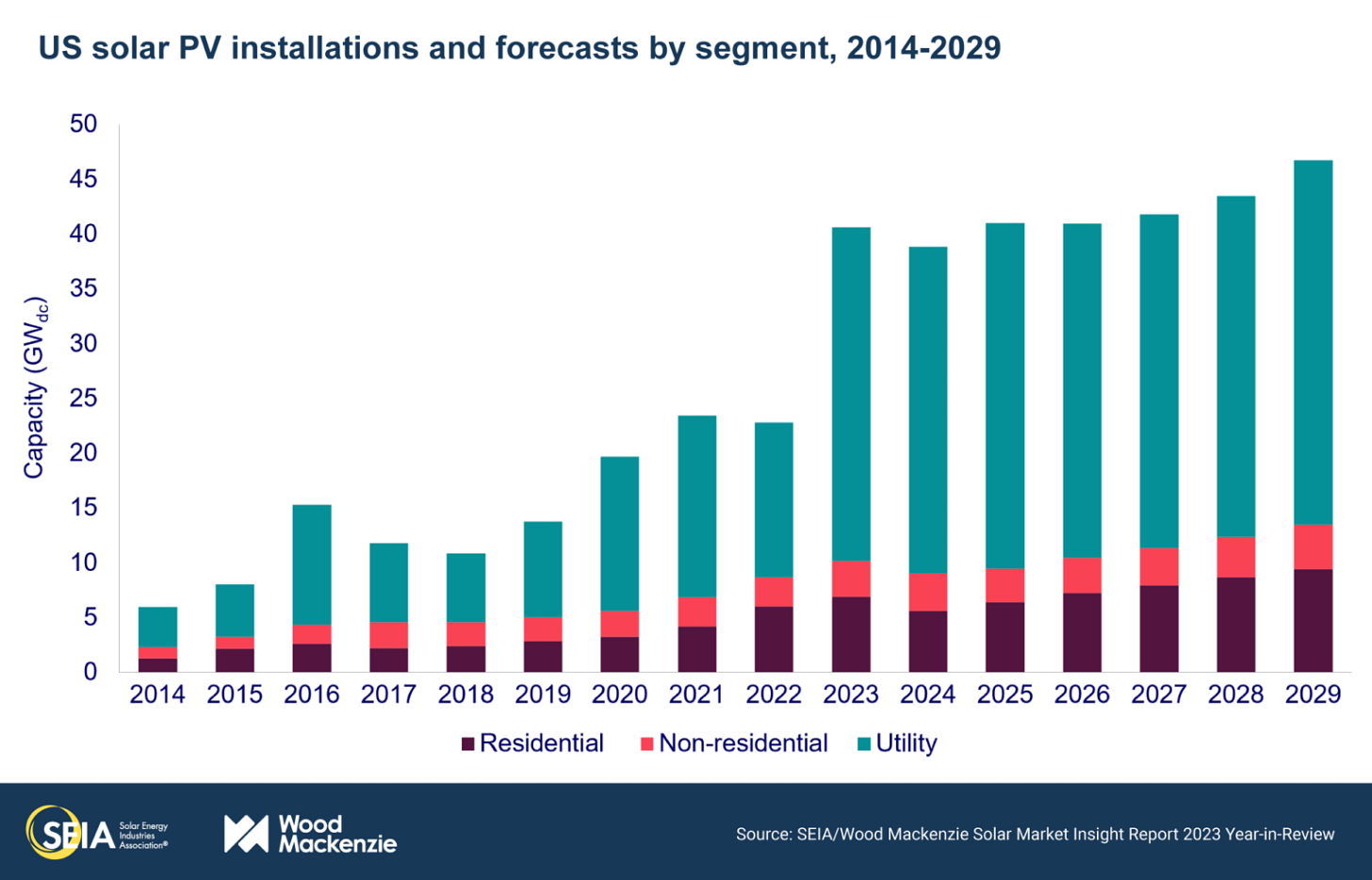

100 GW – $40 BN of US solar manufacturing has been announced since 2022. US has 50 GW of solar manufacturing capacity and it wants 100 GW by 2030. US has over 540 solar manufacturing facilities.

14 MMTpa - US had planned to increase clean hydrogen production from less than 1 million metric ton per annum today to 7-9 million metric ton per annum by 2030. There is 14 million metric ton per annum of planned clean hydrogen production projects.

Strategic Analysis: Technology, Infrastructure & Capital Markets

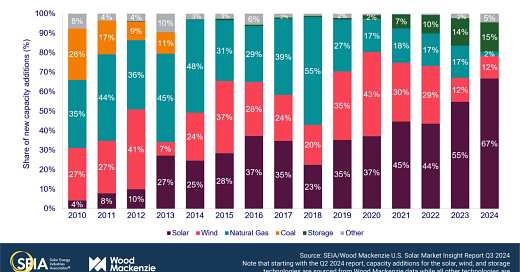

These metrics collectively indicate a robust acceleration in clean energy deployment and manufacturing capacity, though certain sectors remain in early adoption phases. The data suggests significant momentum in domestic manufacturing expansion, particularly in critical sectors such as solar and battery production.

Global Investment and Electric Vehicle Market

The global energy transition investment reached $2.1 trillion in 2024, marking a significant milestone by more than doubling the investment levels observed in 2020. Electric vehicle adoption achieved 10% market penetration in Q4 2024, though this remains below the theoretical 25% threshold typically associated with catalyzing broad societal adoption patterns.

Domestic Manufacturing Expansion

The United States has demonstrated substantial growth in clean energy manufacturing capacity. Battery manufacturing capacity has experienced a remarkable 400% expansion since 2022, increasing from 7 GW to approximately 40 GW. In the solar sector, while China maintains 80% market share in component manufacturing, the United States has implemented significant trade measures, including 60% tariffs under Section 301 on imported solar materials such as polysilicon, wafers, and cells.

Solar Manufacturing Development

The U.S. solar manufacturing landscape has seen considerable development, with $40 billion in new manufacturing commitments announced since 2022. Current domestic manufacturing capacity stands at 50 GW, with strategic targets set at 100 GW by 2030. The manufacturing infrastructure encompasses over 540 facilities nationwide.

Clean Hydrogen Production Trajectory

Clean hydrogen production targets have been substantially exceeded in terms of planned capacity. While initial government objectives aimed to increase production from less than 1 million metric tons per annum (MMTpa) to 7-9 MMTpa by 2030, current planned projects total 14 MMTpa, suggesting accelerated industry adoption and investment in hydrogen infrastructure.

Career Opportunities: Investment and Commercial Banking

Actively placing candidates across all levels in renewable energy finance. For career opportunities, please submit your resume

· Investment Banking Analyst and Associate M&A roles in Biopharma, Consumer, FIG, Digital Entertainment, Life Sciences, Software and Technology.

· Investment Banking Associate roles in Restructuring Advisory

· Commercial Banking Vice President and Senior Vice President roles in Portfolio Management

· Financial Advisor Analyst and Associate roles in Energy Transition and Tax Equity.